Your “charitable checking account” for creating FOREVER VALUE

Do you give to charity regularly?

Do you want to simplify your giving?

Are you interested in maximizing strategic tax savings?

If you answered yes to any (or all) of these questions, a Donor Advised Fund at the Foundation might be a great fit for you!

What is a Donor Advised Fund (DAF)?

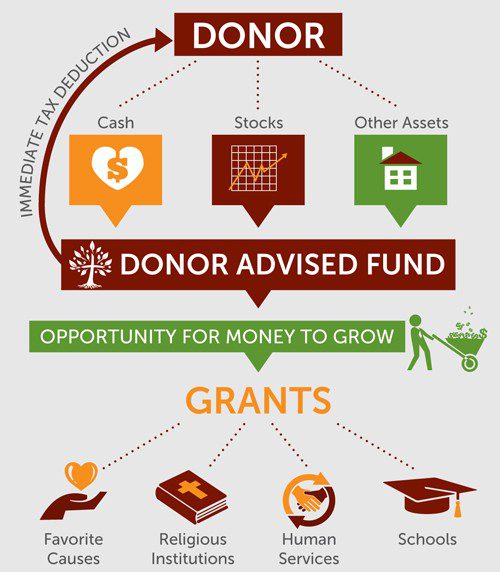

A Donor Advised Fund is a tax-advantaged, convenient vehicle for donating to all the organizations you already love. The donor receives the full tax deduction in the year that the contribution is made to their DAF, but the donor then can take their time in deciding when and to whom they would like to grant this money.

A DAF may advise grants for up to two lifetimes, creating a legacy of philanthropy within a family. The investments will grow tax-free for future grants to charitable causes. In the case of appreciated assets, a Donor Advised Fund can assist you in turning capital gains into charitable gains!

Take Advantage of our Donor Advised Fund MATCH!

Now through December 2024, receive a 6% match on your contributions to your new or existing Donor Advised Fund

Why a DAF with the Catholic Community Foundation?

We know you have choices in the administration of a Donor Advised Fund. Our core value is in providing donors the opportunity to advise grants in their key areas of interest. Commercial funds lack our personal touch and focus on a charitable mission. All fees on our DAFs further the Foundation’s mission and the impact that we have on our local community.

We know you have choices in the administration of a Donor Advised Fund. Our core value is in providing donors the opportunity to advise grants in their key areas of interest. Commercial funds lack our personal touch and focus on a charitable mission. All fees on our DAFs further the Foundation’s mission and the impact that we have on our local community.

As an active grant maker to the local community, we are well equipped to advise you about effective ministries, programs, and organizations that would benefit from your support. Donor Advised Funds with the Foundation can grant to any qualified 501(c)3 as long as the charitable organization engages only in work that aligns with Catholic social teachings. All of the Foundation’s funds are managed under USCCB guidelines for socially responsible investing.

I was looking for a simpler way to give stock to charity. I saw an ad for your Donor Advised Funds and thought, “This is exactly what I’ve been looking for!” I can donate my stock today and then decide which Catholic organizations I want to support over a number of years.

What Do You Get with a CCF DAF?

-

-

-

- High-touch: Staff is available to assist donors with granting and fund management

- High-tech: Online portal allows grants to be made completely online and access to fund balances, grant history, gift history & database of grantees at any time

- All funds are managed under Catholic guidelines for socially responsible investing. Click here for more about our investments >>

-

-

Quick Facts

- Minimum to Open a Fund: $5,000

- Minimum Grant: $250

- Annual Fee: 1%, measured and paid as 0.25% quarterly

- May grant to non-profits across the United States

- May grant to non-Catholic organizations that are aligned with Catholic Social Teaching

How to Get Started

- Review the Donor Advised Fund Agreement Form

- Fill it out and/or ask us any questions you may have

- Submit the agreement form to the Foundation (We will review your form and help clarify any sections that are confusing)

- We will email you the final version of the agreement for you to e-sign

- Once approved and the initial deposit is received, your fund will be opened and ready for granting

Benefits of a DAF

GIVE to charities across the United States (Catholic and non-Catholic organizations)

BUNCH donations strategically for tax savings

GROW your money tax-free

SIMPLIFY your giving from one place – that means one gift receipt for your records!

Bunching & DAFs: Great for Charity, Great for your Taxes

Bunching your charitable donations into a Donor Advised Fund is a win-win for your taxes and for the charities you donate to regularly. Read our article with a 4-year comparison to learn why!

When we were looking to expand our charitable giving, a Donor Advised Fund appealed to us because of the convenience of giving and the opportunities for grant-making that matched our philanthropic interests. We have learned about deserving causes and programs through the helpful communications from the Foundation.

Donor Advised Funds at a Glance

Benefits

- Great way to get a tax break when you have a large taxable event (e.g. IPO stock) but want to take your time advising where the money will go

- Serves as a clearing house for all your stock so that it’s simple to give to smaller organizations that can’t process stock

- CCF is a local grant maker and can help you identify local ministries, programs and organizations that would benefit from your support

- A fund can grant for up to two lifetimes which creates a legacy of philanthropy in that family

- “Kitchen Table Philanthropy” using a DAF encourages families to think about charity together and teaches children about social impact

Financial

- $5,000 minimum starting investment

- 1% annual fee which helps fund the Foundation’s mission and impact on our local community

- Individual grant requests must be at least $250

- We recommend 25% of grants support local Catholic causes

- All funds are managed under the United States Conference for Catholic Bishops (USCCB) guidelines for socially responsible investing

Services

- Individualized customer service and recommendations of organizations for granting based on your interests

- Donor may advise grants to non-Catholic organizations that do not go against Catholic social teaching

- Online portal allows access to fund balances, grant history, gift history, & database of grantees

- Advise grants to organizations anywhere in the US

- Grant checks will be mailed within 30 days of the request

- No limit on the number of grants a donor can recommend

Donor Advised Fund vs. Private Foundation

Click to Open the Comparison Chart

Feature |

CCF DAF |

Private Foundation |

| Set-Up Cost | None | Legal & Accounting |

| Ease of Set-Up | A simple form & can grant as soon as funds received | Can take months, including set-up with IRS and state |

| Amount to Open | $5,000 | $500,000+ |

| Valuation of Gifts for Charitable Deduction | Fair market value | Fair market value for publicly traded stock. Cost basis for all other gifts including gifts of real estate |

| Tax Deduction as a Percent of Adjusted Gross Income | Cash: 60% Appreciated assets: 30% | Cash: 30% Appreciated Assets: 20% |

| Excise Tax | None | 2%, typically |

| Anonymity | Possible, if desired | Typically not possible |

| Set-Up Costs | None | Legal & Accounting |

| Admin Fees | 1% plus investments | Costs of lawyers, accountants, staff, etc. can be significant |

| Fillings Required for Donor | None | Annual Return |

| Succession at Death | Varies | Board names successors |

| Investment Options | Choice of Foundation investment pools and some opportunity for increased donor direction | Wide range of securities and the Foundation exercises control over investments |

| Run Programs | A DAF only issues grants to 501(c)(3) charitable orgs | A foundation may run programs and pay for related expenses (within IRS guidelines) |

| Grant Recipients | 501(c)(3) organizations only | Can be individuals and grant making decisions fully controlled by the Foundation |

| Annual Minimum Distributions | None | 5% of assets |